What Happened to the Impending Recession?

For years now, we’ve heard predictions of an impending recession. The word now is that it never came and is now no longer a threat. That’s what you will read in the entire business press. So just relax!

What can we make of this? It’s unwise to rule out the unexpected. At any time, the stock markets could crash, big banks could fail, and the profitability of U.S. businesses could plummet, leading to mass unemployment. Such a crisis could be just around the corner.

But let’s say we just keep slogging along as we are now, with persistently high inflation, low levels of output, and unemployment that is not statistically terrible? Here’s where matters get complicated.

All along I’ve held a minority view. I don’t believe that the U.S. economy ever really recovered from the last forced recession of March 2020. The lockdowns permanently changed everything. We are not the same as we were, and the data are no longer trustworthy. All the main indicators are fake and manipulated, from unemployment to output to inflation and even to inventories and sales.

More on that in a bit, but let’s first review some history on why we even track booms, busts, and business cycles generally.

In the 20th century, a cottage industry was born to discern the causes and fixes for the business cycle. These are economy-wide swings in output characterized by two parts. The recession is deep unemployment, plunging productivity not just in one industry but all, a fall in sales and income, and falling living standards. The recovery follows with boom times, characterized by the opposite.

What in the world could cause these swings? This issue became hugely important in the global depression of the 1930s. Countless treatises and theories appeared for many decades to figure it all out.

Did you ever wonder why wild and economy-wide swings in output and employment were not obvious in the 19th century and for the many centuries before? Yes, there were industries that came and went and countries that mismanaged their finances that paid a heavy price. But there was nothing like a global depression that could be charted.

In the end, it was clear where his sympathies were. He blamed the central bank for distorting the pricing signal of the interest rate. This affects industrial borrowers who expand production in ways that cannot be sustained with underlying savings. That produced an artificial boom in capital-heavy industries (a category that changes over time). That boom is unsustainable and the lack of underlying economic health triggers the correction.

Once the correction arrives, there is only one wise way out: Let it happen. That’s what the Coolidge administration did in 1923 and the Reagan administration did in 1981. Once the bad investments are cleansed from economic structures, the economy is set for recovery. But that’s not what happened in 1930 and not what has happened since 1982. These days, the central bank and the government generally attempt to dig their way out of recession but doing this only makes matters worse.

What happened this time around? It was the strangest recession in history. The economy was booming in early 2020 with few serious threats on the horizon. But in the middle of March, the world panicked over a virus and pursued insane methods of infectious disease control that utterly smashed small businesses, international supply chains, and social functioning generally. The central managers tried to cover the carnage with money printing and astonishing government spending.

A year later, the consequences became obvious in the form of inflation that is still with us. Meanwhile, industrial structures have been distorted beyond anything we’ve ever seen. Millions dropped out of the labor force and haven’t returned, wrecking the ability to track what we call unemployment. Output is also distorted, as is sales and savings and everything else. The Fed tried to reverse its egregious error with high interest rates that have made home ownership impossible for most borrowers, so the housing market is being kept alive by well-heeled cash buyers from financial powers.

In this same time, the size and reach of government grew astoundingly. It now involves itself with everything in industry, media, medicine, and tech. One never knows anymore the loyalties of any institution apart from the smallest local business. With government on the march, growing beyond that invariably attracts parasites from the public sector who invade, tax, regulate, and surveil with the purpose of incorporating the business into the growing corporatist system of command and control.

Could it be true that the business cycle will not behave in our times as it did in the past? Certainly. The old models of the business cycle presumed functioning markets and industrial structures that were highly sensitive to market signals. That is ever less true, so it is possible that we have entered into a long-run stagnation that is planned and desired by elite interests.

Notice the popularity of the term “degrowth.” For many, this is the goal. It’s why “fossil fuels” have been so demonized while our elite planners extol wind and solar that consumers reject and cannot possibly provide for modern industrial needs. It’s why the same gang is attacking independent farmers and small businesses, in addition to trying to hobble uncensored media outlets.

Nothing works like it should. All the economic data being pumped out now as though these are normal times are fake. The data collection is compromised by the refusal of many households and businesses to even participate, plus the results are often not adjusted for the dramatic decline in purchasing power.

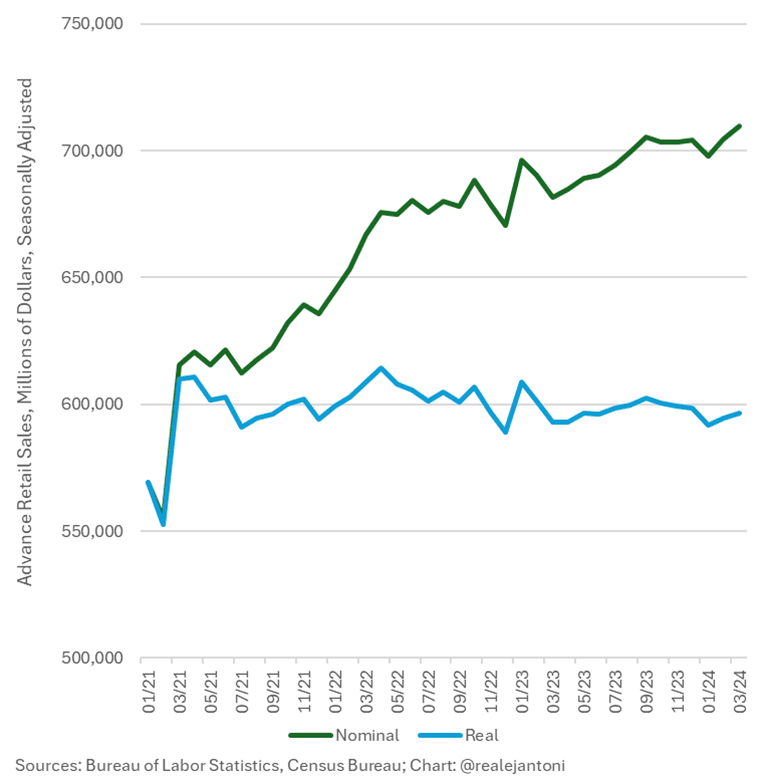

Just look at retail sales. All the headlines this week have said that they are exploding and defying all expectations in a wonderful way. They are proof that we are doing very well. The only economist I’ve seen who has adjusted these for inflation is A.J. Antoni of the Heritage Foundation. He simply adjusted the data for inflation, and guess what?

The recovery is an illusion. The recession might never arrive because, by postwar standards of actual economic growth, it is already here and we are acculturated to it.

This kind of chart tells you all you need to know. The recession is already here and might be our new normal. In that case, and in Orwell’s world, our elites can say that the economy is growing and not falling into recession. In short, we are being lied to. It just takes a bit to explain. If the business cycle is not behaving as it once did, it is because the economy isn’t either. The crisis is permanent.

No comments:

Post a Comment