Democrats Are Fooling Themselves About Tax Reform’s Unpopularity

Like Obamacare, people don’t know what’s in the Republican tax bill. Unlike Obamacare, they’re probably going to be pleasantly surprised.

The 2018 Democrats, top political analysts inform us, will use the soon-to-be passed tax reform as a way to argue that the GOP is the party of the plutocracy. Which is just another way of saying that Democrats are going to use the same argument they’ve been using for the past three decades with varying degrees of success. I’m not sure this development should rattle any supporter of rate reductions. Especially if they consider most Americans don’t even know they’re getting a cut.

A number of liberals have claimed that the passage of “unpopular” tax reform (judging from coverage it seems that the word “unpopular” must be affixed to any mention of tax reform) is that it is historically analogous to the passage of Obamacare, which triggered the loss of hundreds of Democrat seats and perhaps control of the presidency.

This wishful thinking for a number of reasons.

Yes, the tax bill is unpopular. Then again, I’m not sure you’ve noticed, everything Washington tries to do is unpopular. Nothing polls well. Not the president. Not congress. Not Democrats. Not legislation. Not evenerstwhile popular-vote winning candidates. Certainly a bill being bombarded with hysterical end-of-world claims rarely debunked by the political media is not going to be popular. Republicans won’t pass anything if they wait around for it to be popular. But, funnily enough, they can be somewhat content knowing that voters will probably like it once they find out what’s in it.

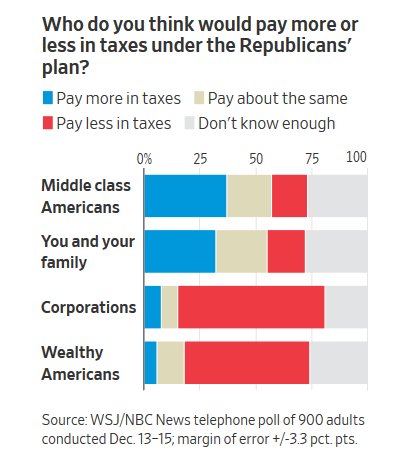

According to a WSJ poll, 17% of Americans think they will pay less in taxes.

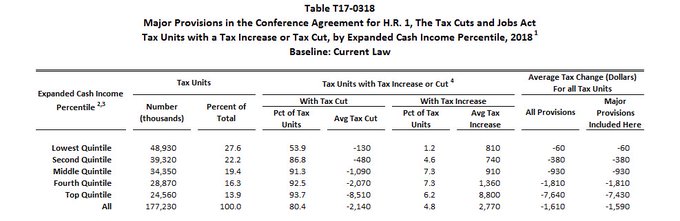

According to the Tax Policy Center, 80.4% of Americans will pay less taxes.

Why do so many Americans believe that middle class is getting a tax hike? Because those they trust are constantly lying to them. Both in framing and content, the coverage of the tax cuts has been impressively dishonest. “One-Third of Middle Class Families Could End Up Paying More Under the GOP Tax Plan” writes CNN (They won’t). The Associated Press says, “BREAKING: House passes first rewrite of nation’s tax laws in three decades, providing steep tax cuts for businesses, the wealthy.” And so on.

There will always be ideological arguments regarding the efficacy oftax cuts for corporations and the wealthy, but at some point people are going to find out that they’ve gotten one, too. Non-partisan liberals at the Tax Policy Center concede that 80 percent of Americans would see a tax cut in 2018 and that the average cut would be $2,140 – which might be something to scoff at in DC but I imagine a bunch of voters surprised by these savings will be less cynical. Only 4.8 percent of Americans will see a tax increase.

Like Obamacare, people don’t know what’s in the bill. But unlike Obamacare, the repeal of the individual mandate merely gives millions a choice. The passage of Obamacare upended lives. ACA would become synonymous with “health care insurance,” and everything that went wrong with that insurance would be attributed to the bill by voters. And since Democrats offered a litany of fantastical promises about the future of health care, the disapproval was well deserved. Millions began losing their insurance plans as soon as Obamacare was implemented, despite assurances from the president and pliant Democrats that no such thing would happen. For many, premiums in the individual markets doubled over four years of Obamacare. These are tangible, real-life consequences that voters dealt with.

Republicans are telling themselves same thing D’s told themselves about the ACA: once the law goes into effect people will actually like it. With ACA that was true, but it took 8 brutal years.

Whatever valid concerns there are about debt or spending (and they are valid,) the idea that tax cuts will have similar long-term consequences on voting as health care is unlikely. It is more likely that tax cuts will do little to change the dynamics of the coming years at all. But it is plausible that, because of the overreaction from the Left, millions of Americans who thought they were going pay more in taxes will find a new child credit and be thankful.

As an ideological matter, every time a Democrat claims that keeping more of your own money is tantamount to stealing –which is all the time – voters should remember this is fundamentally a debate between people who believe the state should have first dibs on your property and those who don’t. The only way to frame the bill as a tax hike is by using the 2025 expiration of individual rate cuts. And the only way they won’t be extended is if Democrats decide to raise taxes again. These are debates Republicans should embrace.

That’s not to say tax reform will save the day. Historically speaking, it’s likely the party in power will lose a bunch of seats in 2018 midterms. But to claim, as Democrats are sure to do, that those loses are unique or tied to the toxicity of an agenda item – particularly a tax cut, which is generally popular among Americans (when they know it exists) – is far-fetched.

David Harsanyi is a Senior Editor at The Federalist. Follow him on Twitter.

No comments:

Post a Comment