by Dan Mitchell

Singapore has been in the news because one of the Facebook billionaires has decided to re-domicile to that low-tax jurisdictions.

Some American politicians reacted by blaming the victim and are urging tax policies that are disturbingly similar to those adopted by totalitarian regimes such as the Soviet Union and Nazi Germany.

Maybe they should go on one of their fancy junkets instead and take a visit to Hong Kong and Singapore. Even with first-class airfare and 5-star hotels, taxpayers might wind up benefiting if lawmakers actually paid attention to the policies that enable these jurisdictions to grow so fast.

They would learn (hopefully!) some of what was just reported in the Wall Street Journal.

Facebook co-founder Eduardo Saverin’s recent decision to give up his U.S. citizenship in favor of long-term residence in Singapore has drawn fresh attention to the appeal of residing and investing in the wealthy city-state and other parts of Asia, where tax burdens are significantly lighter than in many Western countries. …Some 100 Americans opted out of U.S. citizenship in Singapore last year, almost double the 58 that did so in 2009, according to data from the U.S. Embassy in Singapore. …The increase of Americans choosing to renounce their citizenship comes amid heated tax debates in the U.S. Many businesses and high-income individuals are worried…[about]…tax increases in future years.It’s not just that America is moving in the wrong direction. That’s important, but it’s also noteworthy that some jurisdictions have good policy, and Hong Kong and Singapore are always at the top of those lists.

The Asian financial hubs of Singapore and Hong Kong, on the other hand, have kept personal and corporate taxes among the lowest in the world to attract more foreign investment. Top individual income-tax rates are 20% in Singapore and 17% in Hong Kong, compared with 35% at the federal level in the U.S., according to an Ernst & Young report. The two Asian financial centers have also been praised by experts for having simpler taxation systems than the U.S. and other countries. …The tax codes are also more transparent so that many people don’t require a consultant or adviser.Keep in mind that Hong Kong and Singapore also avoid double taxation, so there’s nothing remotely close to the punitive tax laws that America has for interest, dividends, capital gains, and inheritances.

One reason they have good tax policy is that the burden of government spending is relatively modest, usually less than 20 percent of economic output (maybe their politicians have heard of the Rahn Curve!).

No wonder some Americans are shifting economic activity to these pro-growth jurisdictions.

“The U.S. used to be a moderate tax jurisdiction compared with other countries and it used to be at the forefront of development,” said Lora Wilkinson, senior tax consultant at U.S. Tax Advisory International, a Singapore-based tax services firm that specializes in U.S. taxation laws. Now “it seems to be lagging behind countries like Singapore in creating policies to attract business.” She said she gets at least one query per week from Americans who are interested in renouncing their citizenship in favor of becoming Singaporeans. …Asian countries offer a business climate and lifestyle that many find attractive: “America is no longer the Holy Grail.”That last quote really irks me. I have a knee-jerk patriotic strain, so I want America to be special for reasons above and beyond my support for good economic policy.

But the laws of economics do not share my sentimentality. So long as Hong Kong and Singapore have better policy, they will grow faster.

To get an idea of what this means, let’s look at some historical data from 1950-2008 on per-capita GDP from Angus Maddison’s database. As you can see, Hong Kong and Singapore used to be quite poor compared to the United States. But free markets, small government, and low taxes have paid dividends and both jurisdictions erased the gap.

Wow, America used to be 4 times richer, and that huge gap disappeared in just 60 years. But now let’s look at the most recent data from the World Bank, showing Gross National Income for 2010.

It’s not the same data source, so the numbers aren’t directly comparable, but the 2010 data shows that the United States has now fallen behind both Hong Kong and Singapore.

These charts should worry us. Not because it’s bad for Hong Kong and Singapore to become rich. That’s very good news.

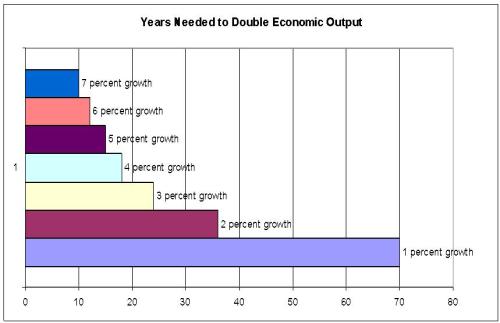

Instead, these charts are worrisome because trend lines are important. Here’s one final chart showing how long it takes for a nation to double economic output at varying growth rates.

As you can see, it’s much better to be like Hong Kong and Singapore, which have been growing, on average, by more than 5 percent annually.

Unfortunately, the United States has not been growing as fast as Hong Kong and Singapore. Indeed, last year I shared some data from a Nobel Prize winner, which showed that America may have suffered a permanent loss in economic output because of the statist policies of Bush and Obama.

What makes this so frustrating is that we know the policies that are needed to boost growth. But those reforms would mean less power for the political class, so we face an uphill battle.

http://danieljmitchell.wordpress.com/2012/05/19/american-politicians-should-learn-some-policy-lessons-from-hong-kong-and-singapore/

No comments:

Post a Comment